Oil & Gas projects are extremely challenging due to geological, environmental, technical and organizational complexities. Beyond the need for drastic treatment of safety and environmental issues, other risks affecting cost, time and revenues can also have detrimental effect on project economics.

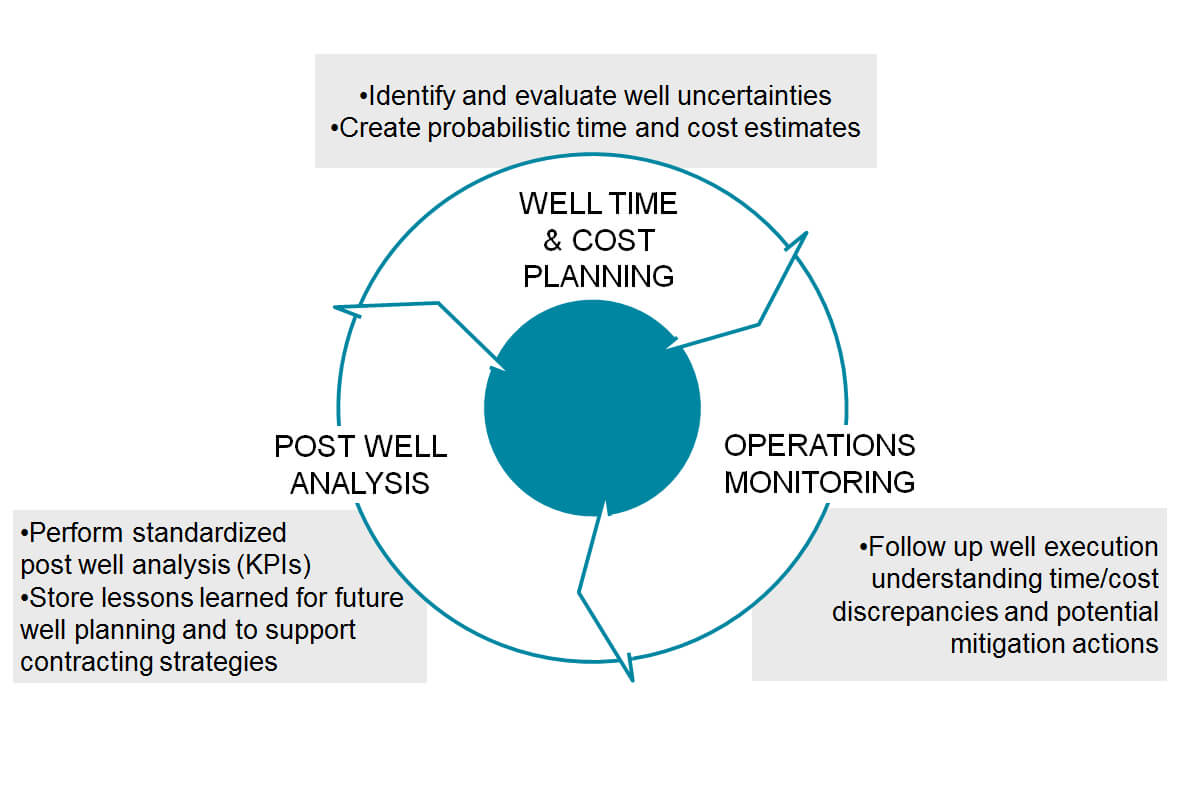

These risks must be addressed continuously throughout all project life cycle: as uncertainties during planning, then as troubles (Non Productive Time) during operations, and finally as lessons learned during post project analysis.

Risk Management Process Implementation

To tackle this issue, kwantis developed and implemented an integrated system to manage projects risks and associated cost/time estimates.

The process uses several practices, such as:

– addressing uncertainties through quantitative (probabilistic) models, that provide better accuracy in operations planning and an univocal definition of contingencies,

– measuring mitigation action effectiveness in terms of costs versus benefits,

– using a combination of automatic systems and daily reports to calculate accurate operations performance indicators,

– monitoring actual cost and time variations versus planning, as a rich source of lessons to be learned.

“Save cost through better budget resources allocation”

This process now in use in all eni’s affiliates, has dealt with more than 140 projects worldwide, demonstrating its added value in reducing uncertainty in decision making and allocating company resources on the most profitable ventures. The economic benefit of the Integrated Risk Management approach has been effectively measured equal to the 1,5% of the overall investment or CAPEX (Capital Expenditure) thanks to an higher accuracy in project cost estimates (reduced amount of immobilized financial and misallocated resources).