A major oil company was studying an innovative desalination process coupled to a regasification plant. kwantis performed a complete business analysis to evaluate project feasibility, including: market study, public acceptance evaluation, cost revenues analysis, profitability analysis (probabilistic NPV), sensitivity analysis.

Desalination Plant Investment Evaluation

A major oil company was studying an innovative desalination process coupled to a regasification plant. kwantis performed a complete business analysis to evaluate project feasibility, including: market study, public acceptance evaluation, cost revenues analysis, profitability analysis (probabilistic NPV), sensitivity analysis. The market study aimed to define the expected scenario to be included in the business case model. It took into account demand and offer factors at World, European and Italian levels.

The public acceptance evaluation was addressing the NIMBY (Not in My Backyard) effect through a benchmark of similar projects, highlighting the main lessons learned to be implemented during the project planning and execution in order to avoid potential delays on the project.

The cost & revenues analysis was focused first on the cost estimation of the different project items (CAPEX and OPEX), both at a high and detailed level, and second on the evaluation of all the possible streams of revenues.

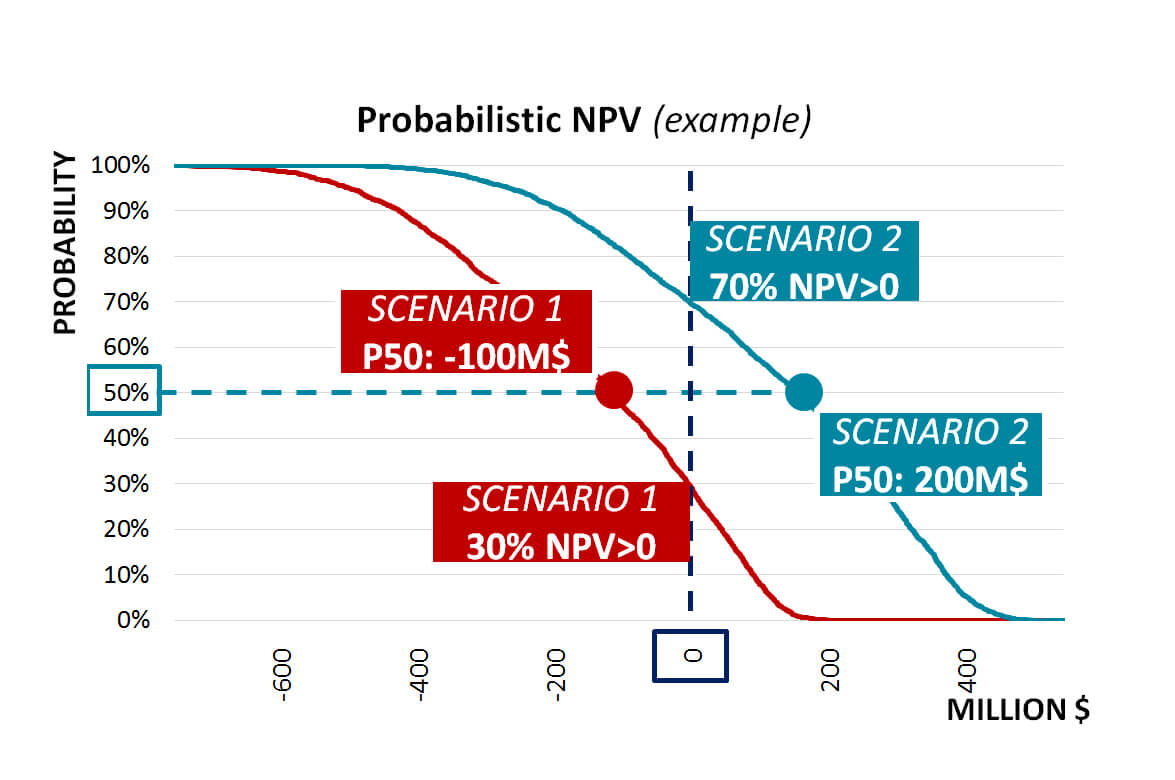

“Comprehensive scenario comparison through NPV probabilistic assessments”

The profitability analysis (NPV and IRR analysis) was performed in a probabilistic way, including all the uncertainties and risks identified in the project Risk Register.

The sensitivity analysis was focused on evaluating alternative conditions to in order to measure their effects on the success of such an investment such as regasification terminal load factor, water price, distance from shore, technical improvements on desalination process.